Churn prevention

Major Swiss bank

Problem

- Significant churn in existing customer base which limits overall growth ambitions in saturated Swiss market

- Large number of customer data available, which was not systematically analysed

- Client advisors often surprised if customers leave

Solution

- Early warning system was created based on a machine learning model to identify customers at risk of leaving or withdrawing a large part of their assets (attrition risk)

- System based on regular monitoring of client behaviour (e.g. transaction behaviour, the intensity of engagement) to predict the attrition risk

- A customer group specific retention approach was developed to pro-actively contact customers with high attrition risk

Impact

- It could be proven that the machine learning model identifies the right customers at risk

- Retention approach has proven to be highly effective since the churn rate of customers at risk could be significantly reduced

- Client experienced strong business benefits, since revenue outflows due to customer churn could be reduced

How AI Assists Portfolio Managers in Gaining Market Intelligence

International Financial Institution

Democratizing Market Intelligence: A GenAI-powered Assistant helping portfolio managers to review market reports, provides an interface for interaction with preferred reports, enables targeted queries and cross-referencing

Challenge

- Portfolio managers today navigate a sea of financial market reports, requiring advanced tools to effectively extract relevant information from a high volume of reports and data received daily from multiple sources

- Cross-Referencing of Market Insights from Diverse Financial Institutions for Portfolio Managers

- Categorize reports based on their content and relevance to specific investment strategies

- Time spent poring over reports detracts from strategic activities like identifying emerging trends, conducting in-depth research, and formulating sophisticated investment strategies

Solution

- Developed a chatbot powered by Generative AI augmented with the latest available market reports

- Intuitive UI enabling targeted queries on selected reports and cross-referencing insights between reports

- The ETL pipeline was implemented to ingest and process the market reports

Business Impact

- Portfolio managers are able to customize their queries and ask specific questions, even referencing multiple reports if needed

- Centralized access: Portfolio managers can interact with their preferred market reports through a single interface

- Facilitates cross-referencing: Solution allows easy comparison of information from multiple reports

- Key insights are presented concisely summarised, alleviating the volume of reports

GenAI-Accelerated Analysis of Risk Documents

Finance Company

Implemented our GenAI Accelerator to enable customers to extract information from risk documents using natural language, ensuring swift access to up-to-date information

Challenge

- Clients faced change management issues regarding hesitation in adopting GenAI due to highly-controlled scrutiny over department.

- Addressing security and privacy concerns: This includes protecting sensitive data and ensuring that the accelerator does not introduce any vulnerabilities

Solution

- Formulated a well-aligned change mgmt. strategy to overcome organizational inertia, individual user resistance and to ensure a smooth transition

- Co-deployed our GenAI Accelerator by collaborating with the client’s DevOps. It involved understanding their infrastructure, requirements, and constraints, allowing us to co-design and implement an effective deployment plan

- Fine-tuned the accelerator’s algorithms, optimized resource allocation, and minimized latency to ensure efficient and fast processing of data

Business Impact

- Streamline operations through faster information retrieval from risk documents using natural language

- Improved team collaboration and alignment by ensuring risk document information was easily accessible and shareable

- Compliance with risk management protocols and regulations

- Launching the first GenAI use case demonstrates company commitment to pioneering technology

Implementing a Secure GenAI Platform and Use Cases

Major Swiss Bank

The bank’s innovative SafeChat project established a comprehensive GenAI governance framework, turning potential AI security challenges into a scalable, enterprise-level technological advantage.

Challenge

- Client wanted to introduce GenAI into the company with a first lighthouse use case. The priorities for customer were:

- ensure that the employees have a compliant and secure way to interact with an LLM Chatbot

- mitigate the risk of data leaks from employees using authorised solution like ChatGPT with private accounts

- build the technical foundation and acceptance to build more advanced use cases in the future

- There was no established framework for secure generative AI service integration

Solution

- OpenAI Service Integration into the bank’s official Azure infrastructure

- Developed SafeChat application using internal Java application development framework including:

- Detailed approvals

- Robust documentation

- Comprehensive support organization

- Extended SafeChat with RAG (Retrieval-Augmented Generation) Chatbot for two specific use cases

Business Impact

- Established first GenAI service platform acting as a security and compliance gateway

- Created a scalable model for future GenAI use cases across the bank

- Enabled secure and compliant generative AI interactions

- Successfully deployed SafeChat to over 6,000 users

- Built technical and conceptual foundation for enterprise-wide AI integration

- Mitigated risks associated with unauthorized AI tool usage

Building a Comprehensive Compliance Framework for Financial Innovation

Major Swiss Bank

The initiative created a scalable AI governance model that systematically addresses regulatory pressures while enabling responsible and structured AI innovation across the organization.

Challenge

- Increasing scrutiny from FINMA (Swiss Financial Market Supervisory Authority)

- Urgent need to establish comprehensive AI governance framework

- No existing processes or structured approach to AI governance

- Organizational Immaturity:

- Newly formed AI Center of Excellence (CoE) lacking mature governance capabilities

- Complex challenge of aligning multiple stakeholder teams: Security, Architecture, Risk Management, IT Management, Model Management

Solution

- Comprehensive AI Governance Framework developed:

- risk-based obligations and standardized checks for AI use cases and models

- Key governance elements based on: FINMA regulations, EU AI Act, NIST AI Risk, Management Framework

- Governance Elements:

- Standardized AI use case documentation requirements

- Comprehensive testing and validation protocols

- AI inventory concept with defined roles and processes

- Due diligence checklist for third-party AI services and products

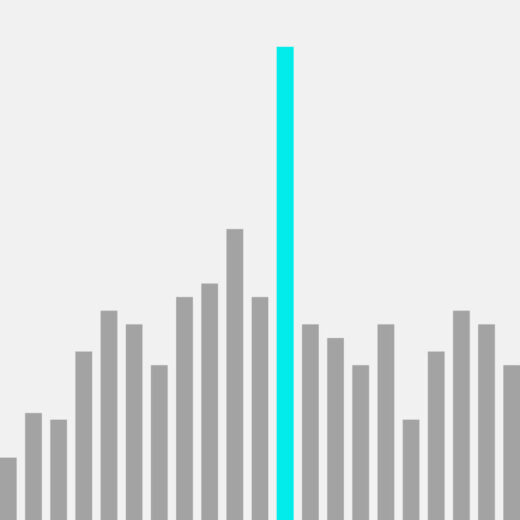

Platform Performance Optimisation

Major Swiss Bank

Optimised platform performance with a set of tools and best-practices combined with coaching, resulting in lower costs and smoother user experience

Challenge

- Platform adoption skyrocketed and rate of increase is higher than what new hardware added is capable of handling

- Usage expected to keep climbing as more projects are being onboarded, leading to further cost increase and performance degradation

Solution

- Established performance metrics baseline

- Coached client’s engineers to enable them to improve platform performance

- Created tooling and reports to pinpoint performance problems and allow self-service improvements

Business Impact

- Reduced new hardware addition and maintenance costs

- 20% cost reduction (ca. CHF 1m/ year saving) on platform infrastructure

- 90% reduction of platform incidents

- Increase in platform performance resulting in smoother user experience

Portfolio Monitoring and Reporting

Major Swiss Bank

Refactored an entire codebase making the pipeline run time 7x faster, allowing quicker new feature development, and increasing data quality for analysis

Challenge

- Legacy Dashboard Environment with critical risk monitoring tools built over several years

- Technical Debt Accumulation resulting in an entangled, poorly-documented codebase

- Performance bottlenecks causing slow system response and analytics delays

- Innovation Paralysis where new feature requests face extended implementation timelines

Solution

- Analysed, simplified and refactored the entire codebase to better future-proof the project

- Solution leveraged was the Unified Foundry Ontology (UFO) that we had previously developed

- Pure foundry solution combined with Unit8’s programming expertise and best practices

Business Impact

- Increased code quality and resolved bugs that accounted for millions of CHF in exposure reporting deviations

- Reduction of pipeline execution time from 10h to 90 min, resulting in fresher data available for analysis

- Allowed smoother onboarding of 200+ users

- Established scrum and coding best practices

Regulatory Compliance of FinTech using Automated Risk Assessment

Financial Institution

Automated Customer-Risk Assessment (CRA) solution with improved number of risk-factors and auditable process with an intelligent due diligence workflows

Challenge

- Financial institution needed to meet increasingly stringent regulatory compliance requirements

- Manual customer risk assessment processes were resource-intensive

- Risk evaluation documentation was difficult to track and audit

- Regulatory penalties and reputational damage potentially poses serious business risks

Solution

- Developed custom Foundry module for systematic customer risk assessment using predefined risk factors

- Created interactive due diligence module enabling compliance officers to efficiently review, modify, and verify customer risk profiles

- Implemented intelligent scheduling system to automatically flag accounts requiring periodic review based on risk level

- Integrated solution with existing customer management systems for seamless workflow

Business Impact

- 97% improvement in customer quality ratings during audits

- Reduced manual compliance review time

- Automated scheduling eliminated missed verification deadlines, reducing regulatory exposure

Regulatory Compliance of FinTech & 97% improvement in customer quality ratings

Financial institution

Automated Customer-Risk Assessment (CRA) solution with improved number of risk-factors and auditable process with an intelligent due diligence workflows

Challenge

- Financial institution needed to meet increasingly stringent regulatory compliance requirements

Manual customer risk assessment processes were resource-intensive - Risk evaluation documentation was difficult to track and audit

- Regulatory penalties and reputational damage potentially poses serious business risks

Solution

- Developed custom Foundry module for systematic customer risk assessment

- Interactive due diligence module enabling compliance officers to efficiently review, modify, and verify customer risk profiles

- Implemented intelligent scheduling system to automatically flag accounts requiring periodic review based on risk level

- Integrated solution with existing customer management systems

Business Impact

- 97% improvement in customer quality ratings during audits

- Reduced manual compliance review time

- Automated scheduling eliminated missed verification deadlines, reducing regulatory exposure

Portfolio Monitoring and Reporting

Major Swiss Bank

Refactored an entire codebase making the pipeline run time 7x faster, allowing quicker new feature development, and increasing data quality for analysis

Challenge

- Legacy Dashboard Environment with critical risk monitoring tools built over several years

- Technical Debt Accumulation resulting in an entangled, poorly-documented codebase

- Performance bottlenecks causing slow system response and analytics delays

- Innovation Paralysis where new feature requests face extended implementation timelines

Solution

- Analysed, simplified and refactored the entire codebase to better future-proof the project

- Solution leveraged was the Unified Foundry Ontology (UFO) that we had previously developed

- Pure foundry solution combined with Unit8’s programming expertise and best practices

Business Impact

- Increased code quality and resolved bugs that accounted for millions of CHF in exposure reporting deviations

- Reduction of pipeline execution time from 10h to 90 min, resulting in fresher data available for analysis

- Allowed smoother onboarding of 200+ users

- Established scrum and coding best practices

Comprehensive Compliance Framework

Major Swiss Bank

Navigating AI Governance: Building a robust compliance and governance framework to systematically addresses regulatory requirements set by FINMA and the EU AI Act, while fostering responsible AI innovation across the organisation.

Challenge

- Urgency to establish a comprehensive AI governance framework due to increased scrutiny from the Swiss Financial Market Supervisory Authority (FINMA).

- Absence of a structured approach to AI governance, coupled with a complex stakeholder ecosystem involving Security, Architecture, Risk Management IT and others, posed significant challenges

Solution

- Implemented a comprehensive AI Governance Framework that introduced risk-based obligations and standardized checks for AI use cases and models, aligned with FINMA regulations, the EU AI Act and the NIST AI Risk Management framework

- Introduced various governance elements, including standardized AI use case documentation, comprehensive testing protocols, an AI inventory, refined roles and processes and due diligence checklists for third-party AI products

Business Impact

- Established a foundational AI governance framework with a standardised approach to AI use case development

- Achieved regulatory readiness and significantly reduced compliance, reputational and financial risks.

Data Platform Audit

Swiss Private Bank

Assessing current custom-made data platform to make recommendations on the best approach and create valuable insights for future platform strategy

Challenge

- Client wanted to assess current capabilities and maturity of their custom-made data platform

- Need to compare current setup to potential future alternatives

- Required an assessment to decide on future platform strategy and to investigate recurring issues raised by users

Solution

- Delivered platform assessment across 4 dimensions:

- data platform tooling and process capabilities

- data analytics and science platform strategy

- data driven use-cases

- platform development

- Assessed strengths & weaknesses in depth and developed recommendations for Data Platform team

Business Impact

- Increased awareness on strengths and weaknesses of custom-made platform in different application scenarios

- Recommendations for a hybrid approach: custom-made ingestion and off-the-shelf platform for Analytics capabilities

- Decision basis for future platform strategy

Data Platform Suitability Assessment

Swiss Financial Services

Compared two existing data platforms (Cloudera & Foundry) to determine the suitability of each solution and define a future platform strategy

Problem

- Leading Swiss Financial Services wanted to compare scope and maturity of two of their deployed Big Data platforms (Cloudera and Palantir Foundry)

- Assessment required for compliance reasons and to decide on future platform strategy

Solution

- Compared platforms across 5 dimensions:

– data management and governance

– data engineering

– analytics & science

– security

– platform openness - Assessed strengths & weaknesses in depth and developed recommendations for CDO

Impact

- Increased awareness on strengths and weaknesses of deployed platforms in different application scenarios

- CDO achieved buy-in of compliance department

- Established a good decision basis for future platform strategy initiatives

DWH Assessment

Swiss Cantonal Office

Assessed the data security maturity of a cantonal tax office’s data warehouse and proposed a recommendation roadmap to prepare for a data security audit

Problem

- Tax office developed a Data Warehouse 5 years ago to run short analyses

- Organic, unstructured growth of the DWH led to struggles with data security topics

- Needed a security and maturity assessment for upcoming audit and optimization initiative

Solution

- Leveraged the NIST cybersecurity framework, focusing on security maturity, data lifecycle, connectivity diagram, roles & responsibilities as part of the assessment.

- Developed forward-looking recommendations for data privacy and secure company/team topics

Business Impact

- Delivered a roadmap with timely recommendations, highlighting key risks and ways to reduce them.

- Stakeholders were well-informed and DWH prepared for the upcoming audit

Building an HR Data Science Use Case Roadmap

Swiss Private Bank

Identified and prioritized high-potential HR Data Science use cases resulting in Senior Leadership buy-in to embark on their AI journey with a clear roadmap.

Problem

- Client has embarked on an AI & Data Science journey but is lacking a clear approach to identity and implement high-potential use cases

- Limited knowledge about AI and its capabilities in Human Resources

- Interested in delivering quick-wins to prove value to HR Department and Senior Leadership

Solution

- Identified a long list of 33 potential HR use cases across the employee journey through research and interviews

- Conducted in-depth assessment of Top 6 high-potential use cases in terms of business impact and feasibility, summarised in a ranking

- Built roadmap of use cases with effort estimation and required infrastructure & data

Impact

- Delivered clear HR Data Science roadmap which resulted in Senior Leadership buy-in

- Prioritized list of use cases with highest impact and feasibility was piloted and industrialized which successfully delivered quick-wins and proved value in continuing the HR Data Science journey

Accelerator #1 Data assets management

Major Swiss Bank

Challenge

- Difficulties maintaining code and monitoring data health

- Making assumptions leading to incorrect outputs

- Need to reimplement existing pieces of software

- Big overhead to integrate new data sources for each use-case

Solution

- Trusted, opinionated and reliable code assets that define guidelines and enforce compliance

- Code modules that allow downstream users to consume and interpret data assets

Impact

- Reduced time to onboard new data assets

- Reduced human errors thanks to guideline enforcement

- Increased transparency about availability and content of data assets

- Ensured common understanding of the data model, allowing to scale data asset development efforts

Early Warning Indicators

Major Swiss Bank

Identifying clients that are most likely to have financial problems through an automatic model based on warning indicators to alert credit officers earlier

Challenge

- Credit officers need to assess and manage financial risk for their respective portfolios

- The amount of data collected each day by the risk department and its velocity make it hard to properly monitor and manage risks for every client

Solution

- Help the credit officers to identify and focus on clients that are more likely to have financial problems in the future

- Leveraged Foundry as a data platform and defined early warning indicators – rule base alerts triggered by specific events

- Unit8 implemented those alerts on parameters such as late leasing payments or overdrafts

Business Impact

- Significant simplification of the assessment and monitoring that credit officers need to conduct

- Clear email based alerts that can be easily and quickly reviewed

Client Surveillance

Major Swiss Bank

Identifying clients that are most likely to have financial problems through an automatic model based on warning indicators to alert credit officers earlier

Challenge

- Regulations require the client to setup surveillance for money laundering and illegal activities

- Disparate data sources and formats, and varying regulations between countries

- Inability to monitor client behaviour to spot illegal activities

Solution

- Leveraging a previous project Unit8 conducted (Single Client View), built a generic framework enabling data scientists to easily define surveillance scenarios to monitor potential high-risk client activities

- Pipeline specifically designed to scale to millions of customers tracking billions of equity positions globally

Business Impact

- Greatly reduced amount of time needed to define surveillance scenarios, from weeks to minutes

- Reduced resources required and build-time of pipelines by more than 50%

- Improved reliability of scenarios

- Decreased manpower necessary to conduct surveillance audit by a factor of 20

Single Client ViewDashboard

Major Swiss Bank

Creating a single client view for an international Swiss bank allowing them to track and compute total risk exposure, and meet AML compliance regulations

Challenge

- Siloed data across multiple systems

- Inability to calculate risk exposure

- Lack of unified view of their clients

- Limited ability to meet compliance regulations

- Sub-optimal conditions to apply proper AML

Solution

- Aggregated, cross-referenced and combined data from hundreds of disparate data sources

- Used ML to automatically surface high-risk clients

- Implemented a scalable solution to account for future needs

Business Impact

- Achieved single client view, increasing visibility

- Able to calculate overall risk exposure

- Compliance with AML regulations

- Already stopped previously undetected terrorism-financing activities

Collateral Insight

Major Swiss Bank

Creating a new data pipeline for collateral risk calculations to improve the quality of data information and reporting for end users

Challenge

- Risk calculations on collaterals provided daily to end-users through dashboard

- Need to leverage this risk calculation data model for reporting purposes

- Difficult to identify which data would be required for reporting, and to accurately provide it through previously-built pipeline that wasn’t sustainable

Solution

- Initial discussion to fully understand data sources and existing data flows

- Created new pipeline to extend the already existing data model by including specific information

- Identifying- and providing solutions to issues in the current codebase which introduce data quality issues

- Provide guidelines to prevent similar issues from reoccurring

Business Impact

- Improved data quality of the reports by onboarding the data on the main data processing platform through the newly built pipeline

- Enabled client team to improve and learn by giving tips and providing guidelines

- Reduced disk spillage per TB of data from 50GB to less than 100MB

Portfolio Monitoring and Reporting

Major Swiss Bank

Refactoring an entire codebase making the pipeline run time 7x faster, allowing quicker new feature development, and increasing data quality for analysis

Challenge

- The “Portfolio Monitoring and Reporting” project provides multiple dashboard for risk managers to assess their risk

- Over several years of development, the codebase has become entangled and slow which was blocking the delivery of new features

Solution

- Analysed, simplified and refactored the entire codebase to better future-proof the project

- Solution leveraged was the Unified Foundry Ontology (UFO) that we had previously developed

- Pure foundry solution combined with Unit8’s programming expertise and best practices

Business Impact

- Increased code quality and resolved bugs that accounted for millions of CHF in exposure reporting deviations

- Reduction of pipeline execution time from 10h to 90 min, resulting in fresher data available for analysis

- Allowed smoother onboarding of 200+ users

- Established scrum and coding best practices

Analytics Platform Setup on AWS

Trading Company

Aggregating all marketing data into a single view matching leads to customers to gain a better understanding of marketing campaigns performance and costs

Challenge

- CRM data spread across entities with little to no aggregation at a group, vertical or customer level

- Lack of data integration meant no overall visibility on factors influencing consumer behaviour

- Inability to check marketing investment effectiveness in customer acquisition and retention

Solution

- Created a data pipeline in AWS to aggregate al marketing campaigns, leads, and customer data into a single source of truth (Data Mart) on AWS

- Pipeline cleans data and builds a unified view matching leads with customers

Business Impact

- KPI tracking per advertising platform, campaign and ad spot (e.g. cost per lead, transformation rate, ROI, etc.)

- Transition to a data driven marketing plan rather than based on “gut-feeling” and beliefs

Exploratory Knowledge Graph

Swiss Private Bank

Building up a Neo4j Graph solution to help different divisions map relationships and interactions between people, companies, accounts and assets

Challenge

- Talend ETL and SQL queries resulted in high manual overhead and could not properly maintain relationships between different parties and accounts

- Looking for a more business friendly interface for their bankers

Solution

- Built up a Neo4j environment

- Created a necessary data schema and ingested required datasets

- Leveraged the newly created Neo4j environment to create two required views:

Party

Account

Business Impact

- Self service interface with granular access rules to allow different departments (wealth management, risk, fraud, etc.) to perform their own queries

- Ensured regulatory compliance regarding particular sanctions

Rogue Traders Monitoring

Major Swiss Bank

Developing an ML model to identify potential rogue traders and flag them to minimise risk of financial losses and lower need for regulatory cash reserves

Challenge

- Inability to monitor and identify traders whose behaviour differs from what is expected, resulting in potential monetary and reputational risks for the client

Solution

- Integrated trading data from several sources into a single platform

Deployed ML techniques to identify potential rogue traders based on their trading behaviour - Configured an alerting system to flag traders with an elevated risk of rogue trading

Impact

- Able to quickly identify risky traders based on their trading activities, which would have been impossible to do manually

- Minimised rogue trading risk and potential financial losses, lowering the need for regulatory cash reserves

Platform Performance Optimisation

Major Swiss Bank

Optimising platform performance with a set of tools and best-practices combined with coaching, resulting in lower costs and smoother user experience

Challenge

- Platform adoption skyrocketed and rate of increase is higher than what new hardware added is capable of handling

- Usage expected to keep climbing as more projects are being onboarded, leading to further cost increase and performance degradation

Solution

- Established performance metrics baseline

- Coached client’s engineers to enable them to improve platform performance

- Created tooling and reports to pinpoint performance problems and allow self-service improvements

Impact

- Reduction in new hardware addition and maintenance costs

- Increase in platform performance resulting in smoother user experience

Commodity Trade Finance (CTF) Dashboard

Major Swiss Bank

Creating a dashboard unifying all trading information resulting in a more holistic understanding for credit risk officers and substantial risk reduction

Challenge

- Credit risk officers struggle to understand precisely who they are trading with, what kind of goods are traded, and what are the exposure concentrations

Solution

- Created a dashboard presenting an interactive view of the CTF portfolio and its clients to mitigate risks and recognize business opportunities

- Entity resolution (based on free text sources) to provide a unified view of all external parties involved in the transactions

Impact

- More holistic understanding of CTF business across departments

- Substantial risk reduction through better understanding of exposures

Client Surveillance

Large Swiss bank

Defining and implementing a surveillance framework to identify illegal client behaviour resulting in greatly improved ability to meet surveillance requirements

Challenge

- Regulations require the client to setup surveillance for money laundering and illegal activities

- Disparate data sources, and diversity in regulations between countries

- Inability to monitor client behaviour to spot illegal activities

Solution

- Leveraging a previous project Unit8 conducted (Single Client View), built a generic framework enabling data scientists to easily define surveillance scenarios to monitor potential high-risk client activities

Impact

- Greatly reduced amount of time needed to define surveillance scenarios, from weeks to minutes

- Reduced resources required and build-time of pipelines by more than 50%

- Improved reliability of scenarios

Residual value prediction

German automotive

Problem

- Car manufacturer holds large global leasing portfolio that has to be periodically evaluated

- Current valuation predictions are inaccurate

Solution

- Based on a large volume of past transactions (12 years) and cars parameters (model, mileage, options), etc. predict accurately the residual value of the car

Impact

- Accuracy of the valuation improved by $100M’s (from large overall base value)

Financial health watchlist

Swiss Financial Institution

Developing a centralised solvency and risk assessment model to create risk exposure reports automatically and improve data quality

Challenge

- Difficulty to predict total exposure to financial losses resulting from companies at risk of becoming insolvent

- Current risk reports are generated manually and data quality is not guaranteed

Solution

- Central gathering and processing of the relevant partner data allowing for central risk modelling and data quality checks

- Automatic creation of monthly risk reports based on the curated data

Impact

- Improved risk management capabilities through information centralisation and standardisation

- Improvement in data quality and report generation

- Possibility to create reports dynamically to visualise more aspects than before

User behaviour monitoring

Major Swiss bank

Problem

- Impared visibility of user activity and behaviour allows for malicious behaviour to be undetected for a long period of time

- Compliance group in a global private bank decides to monitor user activity on the central data platform

Solution

- Introduction of dynamic altering and anomaly detection system including enhanced signal information via integration of new sources of data (HR data, badge swipes, VPN logs, … )

Impact

- Greatly improved security, audit and monitoring capabilities of the platform team

- Decreased risk of malicious behaviour remaining undetected

Financial transactions monitoring

Global Swiss Pharma producer

Problem

- Customer struggled with detecting anomalous financial transactions – the current process is labour intense and error prone due to mass volume of the transactions and amount of false positive alerts

Solution

- Unsupervised machine learning system to automatically flag anomalous transactions together with prioritisation based on severity and an explanation why a given transaction can be an anomaly

Impact

- Lower need for manual interaction

- More accurate transactions monitoring

- Quicker time to act on an alert

Single Client View

International Swiss Bank

Creating a single client view for an international Swiss bank allowing them to track and compute total risk exposure, and meet compliance regulations

Challenge

- Siloed data across multiple systems

- Inability to calculate risk exposure

- Limited ability to meet compliance regulations

- Sub-optimal conditions to apply proper AML

Solution

- Aggregated, cross-referenced and combined data from hundreds of disparate data sources

- Used ML to automatically surface high-risk clients

- Implemented a scalable solution to account for future needs

Impact

- Achieved single client view, increasing visibility

- Able to calculate overall risk exposure

- Compliance regulations can be met