- May 19, 2021

- 5 min read

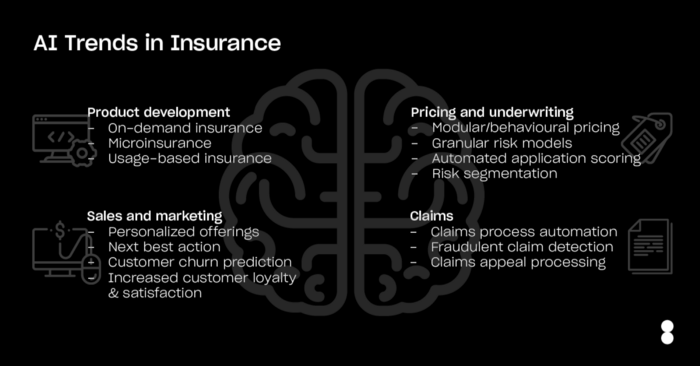

Data has been at the heart of the insurance industry since its beginnings. The explosion of data globally, along with exponential increases in computing power, is driving advances in artificial intelligence (AI). This in turn is creating unprecedented opportunities, especially for insurers where AI has already started to revolutionize the industry.

Popular insurance industry AI applications range from risk management, fraud detection and prevention, personalized offerings and customer churn (attrition) reduction to climate change impact prediction. On-demand and usage-based insurance (UBI) offerings will be driven by AI’s ability to aggregate disparate data sources and ultimately deliver more flexibility to customers.

Product Development

Advanced analytics and AI are expected to become the foundation of new insurance products, allowing for the hyper-personalization of new products and offerings. This iterative process allows features to be continuously added to a product or service. By viewing additional features with this modular mindset, a flexible building-block foundation is created that evolves with new inputs. Any data that future customers might provide from health and fitness trackers (e.g. smartwatches) could be leveraged for more customized insurance offerings.

This type of UBI deviates from the insurance models people are accustomed to. The advantage is that instead of relying on aggregated statistics and past trends, it models individual and current behaviours. This customized offering provides an attractive alternative, given the breadth of lifestyles, habits, cultures and personalities. Data privacy, and more generally peoples’ perception of data usage, is still evolving and will determine the pace at which these offerings will be made available.

Sales and Marketing

“Acquiring a new customer is from 5 to 25 times more expensive than retaining an existing one.”*

The new product offerings mentioned above are allowing companies to offer customized options to potential as well as existing customers. This combined with customer intelligence allows the creation of distinct personas that can be targeted along any part of the customer’s buying journey. By creating such personas and better understanding customer life cycles and buying journeys, insurers can create a “next-best-action” tool. This gives sellers and marketers clear guidance on which offerings will resonate with which customers, thereby enhancing the efficiency of the consumer-focused sales journey.

The conversation is not one-sided, though; customers expect proactive and relevant communication from their insurance providers. Indeed, “57 percent of insurance customers around the world, across all product types, prefer to hear from their providers at least semi-annually; only 47 percent receive that level of contact currently”.* As AI becomes more pervasive, an increasing part of lead identification [customer prospecting], generation, and capture will be automated by AI.

Pricing & Underwriting

With customized insurance products based on hundreds of thousands of customer personas, the pricing and underwriting of these complex insurance policies become equally complicated. Yet traditional insurance pricing models are often still based on simple matrix systems that take a small number of variables into account, leading to high exposure risk and large loss ratios. This static approach to risk modelling will be replaced by a bottom-up approach in which internal data is combined with a growing pool of external data assets (economic, crime rate, credit, traffic and weather data, for example.) This data lake, together with a machine learning framework, will enable more dynamic and forward-looking risk models.

A particularly interesting data source in the property and casualty insurance sector is geospatial data, previously known as geographic information systems (GIS). Insurers now have the ability to perform a detailed analysis of a property using machine learning and computer vision solutions for more accurate and quicker pricing.

Claims

“Fraudulent Claims make up 5–10% of insurers claim costs.” *

The claims process is complex as different claim types follow different processes and involve different departments. From the time a customer submits a claim until the time it is resolved, insurers have the opportunity to prove themselves. This starts with the options the customer is given to submit a claim or to have internet of things (IoT) devices and sensor solutions automatically trigger the filing of the claim.

Data generated in this first step alone will create a library of events that can be used to optimally route claims to the proper department or complete the claims process automatically based on the claim’s severity and complexity. With fraud making up 5–10% of insurers’ claim costs, intelligent automation tools also help reduce fraudulent payouts and help investigators focus on only the most likely fraudulent claims.*

Data

Data is key to all of these topics, and every company across every industry needs to become a data company. Insurance companies that successfully become data-driven will innovate, simplify and improve their customers’ experience while streamlining internal processes. To do this, they will need to rethink their approach to data; archaic designs from the past need to be replaced with agile methodologies that put data at the heart of decision-making.

Companies need to understand that this journey will take time. Key is to have an agile approach that allows quick wins but also quick failures — both of which will likely occur. It is important to keep the customer experience and customer perspectives in mind when developing new strategies, and to reinforce a proper data culture throughout the organization. Otherwise, these initiatives have limited chances of success.

UNIT8

At Unit8, our goal is to drive the adoption of Analytics and AI in the insurance space and help companies close this knowledge gap. The Unit8 team is comprised of world-class experts in machine learning engineering and data science. Our team members have worked for leading digital native companies; we bring their best practices to every project. We partner with some of the biggest companies in the world to solve challenges that directly affect their business. At Unit8, our mission is to drive the adoption of AI and data science in industries and empower organizations.